Market Mondays: A Path to Building Assets and Wealth

There’s never been a podcast like Market Mondays until Market Mondays.

Why?

They’re doing the work “Wall Streeters” never intend to do – speak directly to Black and Brown Americans with the same desire as White Americans to make their lives better through investing.

Normally, I don’t do this. Meaning what you should expect from Ink & Audible is an unbiased review of a podcast, new to my ears as well, to tell you whether you should listen and why.

I’m biased right now. I’ve been a listener for two years. This is a must-listen for me. I’m telling my readers who I want to make aware of the best books, podcasts, and new music that this isn’t something to miss.

Stock market expert Ian Dunlap, Troy Millings, and Ian Dunlap have created something our community needs to connect with and be proud of.

Going From Physical Therapy to Retail Investor

Luck shines brightest during periods of misfortune.

There I am, fresh off the plane after six days in Miami. I'm sporting a mean tan as I lean back inside my Nissan Altima at a stoplight on Georgia Avenue – Washington, DC, y’all.

It’s the summer of 1998, Will Smith’s song Miami is banging out of my trunk. I couldn’t have been happier.

Five seconds after the light changes, the moment's over. A woman in a Black Jeep Cherokee slams into the back of my Nissan Altima, and it’s nearly totaled.

After enduring six plus months of physical therapy on my back and shoulder, a settlement check arrived for $16k, ironically from my own insurance company.

The other driver also had the same auto insurance carrier.

A portion of those funds, $3500, went toward opening a brokerage account with Charles Schwab. One of my good friends had been in my ear for two solid years about investing.

Of course, neither of us knew a damn thing about investing. Two black kids growing up in tiny apartments in Queens, New York, with working-class parents don’t spend time talking about investing.

My aunt schooling me on the importance of a life insurance policy when I was around sixteen stands as the only financial conversation I remember having.

In the place of real knowledge, I turned to CNBC to fill the gap. I bought Money, Forbes, and other financial magazines off the racks.

Somewhere along the way, I became much like today’s memecoin enthusiasts regarding the prospects of Sun Microsystems. You’d think I’d remember what I paid per share. But I don’t.

Only that I invested every penny into Sun Microsystems.

Lessons From My First Big Investment

Initially, I proved to be an absolute genius. My portfolio grew 4x.

Then the dotcom bubble exploded in March 2000, less than a year after I started.

My soul screams, the guys at Market Mondays would have guided me to the light. Instead, I watched my profit sink slowly and steadily, and kept holding on.

The talking heads on CNBC easily left enough room for you to believe the comeback was coming tomorrow, maybe sooner.

I sold and closed my account when it shrank to $2k by June 2002.

Oddly enough, my nose for sniffing out game changing technology companies proved right over time. Sun failed due to poor executive management. The company lives on today in the form of Oracle, which acquired Sun in April 2009.

Their legacy is Java. Sun created and released the Java programming language in 1995. It is the backbone of server-side programming languages today.

Essentially, everything that happens with those Oracle databases happens through Java.

Investing Books That Started My Learning and Education

Fast forward five years to September 2007. I have $40k accumulated in a 401(k) plan from a former employer. I rolled it over to an individual retirement account (IRA) with Schwab.

Mama didn't raise no fools. In that five year gap, I did the homework.

One name reigned above all others as the supreme investor: Warren Buffett. First thing, I read "The Making of an American Capitalist" by Roger Lowenstein.

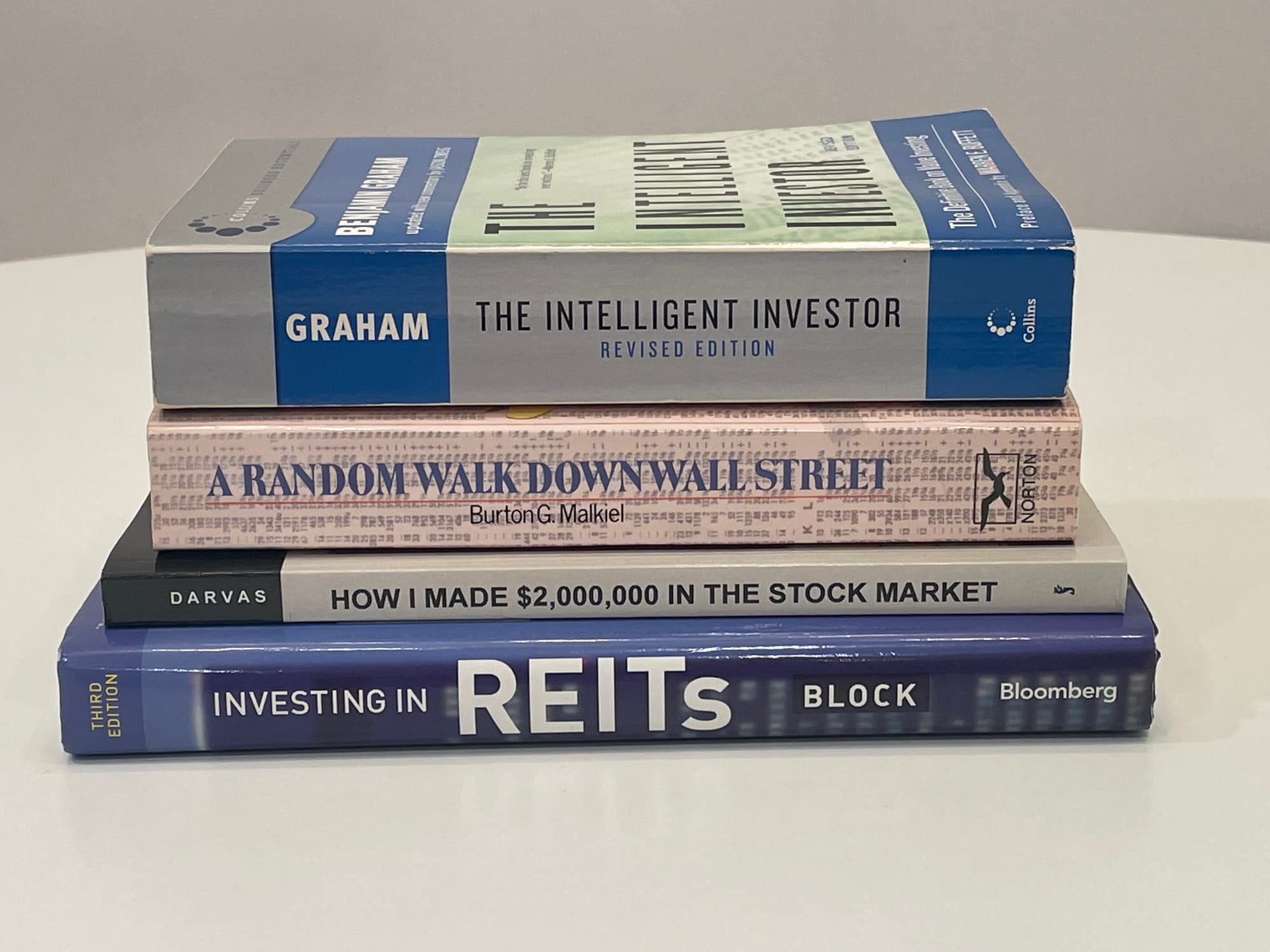

Multiple times, Buffett pointed to a man named Benjamin Graham and the book, The Intelligent Investor, as one of his guides. I read it twice.

I also read:

- A Random Walk Down Wall Street

- How I Made $2,000,000 in the Stock Market

- Investing in REITs

In short, I didn’t come back the way I went out.

Market Insights That Go Beyond Technicals

A novice investor like I was back in 1999 can come to Market Mondays and listen weekly for two hours over the course of six months to a year, and gain most of what I had to extract from reading multiple books over a couple of years.

Dunlap, Millings, and Bilal cover much more than just the technical aspects of investing. They share plenty of the "why" behind what's happening in the market and the economy.

It's understanding why that makes decisions related to stock investing easier.

For this post, I randomly listened to seven episodes. They are:

- Episode 31: Supreme Clientele

- Episode 51: NFTs, Cryptocurrency, Rules to Investing with 19Keys

- Episode 109: Amazon's Stock Split, 8 Signs of a Recession, & Ethereum's Future

- Episode 160: Apple's New VR Headset, NIL Deals, Music, Working with Family, & Marketing with Flau'jae Johnson

- Episode 202: Master Stock Trading, Mortgage Hack, Trump's Meme Stock, Recession, & Lessons From Diddy's Situation

- Episode 230: NVIDIA's Next Stock Move, Tesla's Robots, Bitcoin & The Republican Economic Plan with Byron Donalds

- Episode 264: Trump Calls Peace with Iran: Is Big Tech the New Military?, Will Oil Surge? & Tesla's Comeback

Instead of taking you moment by moment through every one of these episodes, I'm going to call out some of the top insights and conversations.

Market Mondays: Episode 260

The Impact of Holding a Stock Like Microsoft Long-Term

For the sake of simplicity, I’m paraphrasing over quoting word for word.

“The biggest mistake you can make is not being solidly invested between 2020 and 2030.” Ian Dunlap

This goes back to episode 31: Supreme Clientele released on November 9, 2020.

At the time, the Dow Jones Industrial Average (the Dow) was around 28,400, and recently the Dow has risen above 46,000 (September 2025).

Now, let me bring it down a level.

Dunlap has consistently recommended Microsoft as a rock solid holding to keep in your portfolio. Microsoft was selling for roughly $215 per share in November 2020, and trades for approximately $510 per share now.

Buying and holding as little as 100 shares of that stock would have translated into close to $30k in gains. If that’s not valuable, I don’t know what is.

“Diversification is for people who don’t know what they’re doing in terms of investing.” Ian Dunlap

You need context to understand what’s being said here. My eyes have been on the stock market since the day I pushed “Buy” on that first trade for Sun Microsystems in 1999.

During the 2000s, and even more throughout the 1990s, the idea of diversification being the ticket to riches, especially through mutual funds was sold everywhere.

Mutual funds were preached like gospel. Specifically, to the retail investor who it was assumed had little knowledge and understanding related to the complexities of investing.

Step into almost any brokerage at the time and they rolled out a long list of fee loaded funds, pushed the concept of dollar-cost averaging, signed you up, and shoved you out the door.

That my friends was the norm.

It was so bad that even Buffett jumped in to challenge the logic behind that approach. Many, may not remember that he’d challenge a leading fund manager to beat the returns of an S&P Index Fund (low fees) without active management on an annual basis, and very few could outperform the index.

Today, mutual funds which were “The Kings” of the 1990s, have completely ceded their ground to index funds and exchange-traded funds (ETFs).

Dunlap goes a step further. He advocates for buying and holding 4 to 8 long-term positions with sector leading stocks and tracking all news related to them over a ten-year period.

While there are never guarantees, you’re likely to experience gains over a ten-year time horizon with dollar-cost averaging in, similar to what you’d get through buying and holding an index fund (e.g., S&P 500, Sector-based) twenty years, which offers greater diversification but you sacrifice potentially magnificent returns.

Think Differently to Build Your Future

They allow entrepreneurs and investors in a range of assets to share their knowledge frequently on the show. A semi-regular guest to Market Mondays is 19Keys (real name Jibrial Muhammad).

He is a thought leader, futurist, motivational speaker, entrepreneur, podcasters, strong supporter of Black community and culture, and grew up in Oakland as part of the Nation of Islam.

You will consistently hear 19Keys stress the importance of elevating our thinking and high-level conversations. Whenever he joins, you’re sure to hear something that will cause you to pause and think.

“The world is shifting to different institutions. New institutions will rise with new forms of power.” 19 Keys

“UX Design is more important than coding now.” 19Keys

“Forget the institutional educational model and learn from the experience model of diving in and figuring out how AI can empower your ideas.” 19Keys

I’m paraphrasing above. The evidence that the world we have known the last 30, 40 years has begun to fade away, is piling up. It’s a matter now of what are you ready to go and build.

Are you planning on spending the next 50 years fighting to resurrect educational systems that we’re failing for that long?

Are you planning on sinking your hopes into the next set of politicians who are beholden to the constituencies putting in the most money to get them elected?

The challenge is thinking about how the world can look different and what you might attempt to build and do in partnership with your community, and those ready to go around you now to cement a place in the new world.

Listen or Take a Pass

You already know because I said it at the beginning, "This is a must-listen."

The knowledge shared and perspectives gained over two hours with Dunlap, Millings, and Bilal are worth your time.

It's easy to tune in while you're at the gym, running, walking for an hour. Turn on this podcast while you're busy cleaning up the kitchen, bedroom, or bathroom.

Take 30 minutes away from doomscrolling on Instagram and listen. ■

Member discussion